A Credit card default crisis?

It has widely been reported recently that consumer credit card debt has now passed the $1 trillion dollar threshold. This, in conjunction with geopolitical news, wages not keeping up with inflation, banks being downgraded as well news of the US credit rating slipping from AAA to AA is of concern.

Consumers have been keeping up with payments—card and otherwise—until recently. It has been a testament to those consumers that late payments and other delinquencies have stayed low given the current economic climate. Banks and card brands have been able to weather the charge back and write off activity for quite a while, but how long can that last? As consumers struggle to “make ends meet” they have relied upon credit cards to help shoulder the weight.

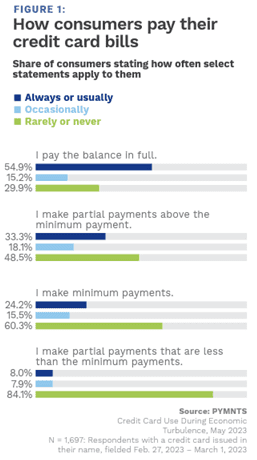

The chart below shows that 55% of consumers pay off their card balances in full monthly. The other 45% who make minimum or partial payments bear the brunt of rising interest rates.

Six of the US’s largest banks recently reported the highest rate of loan loss since the pandemic. It is projected that these six banks alone will have to write off a combined $5 billion loss in Q2 of 2023. Chase realized charge off amounts of $1.1 billion during this time compared to $600 million during Q2 of 2022. Wells Fargo likewise saw credit losses in consumer banking and lending hit $874 million versus the same time period in 2022. Both Capital One and Discover saw credit card delinquency rates outpace pre-pandemic levels in June 2023. It is of little surprise that credit card debt repayment has been the hardest hit as it is an uncollateralized obligation.

Merchants have of course felt the burden of higher interchange fees AND charge backs which have not diminished since the start of the pandemic. Banks in conjunction with card brands set the interchange fees (cost of the cards) based on risk. Some industries such as petroleum have very low interchange fees—others such as online vitamins or vape stores have higher interchange fees. These fees increased over the past few years, some as high as 3.15%! All of these fees add to a merchant’s bottom line and are passed onto the consumer.

Consumers living paycheck-to-paycheck are of course the most inflation-impacted consumers. Subprime borrowers are also feeling the economic impact of inflationary forces as savings run out and credit limits are reached on cards or lines of credit. Indeed, those across the myriad of economic brackets are feeling the pinch. As these limits are tested, a looming credit card default crisis appears to be taking shape.

0 Comments